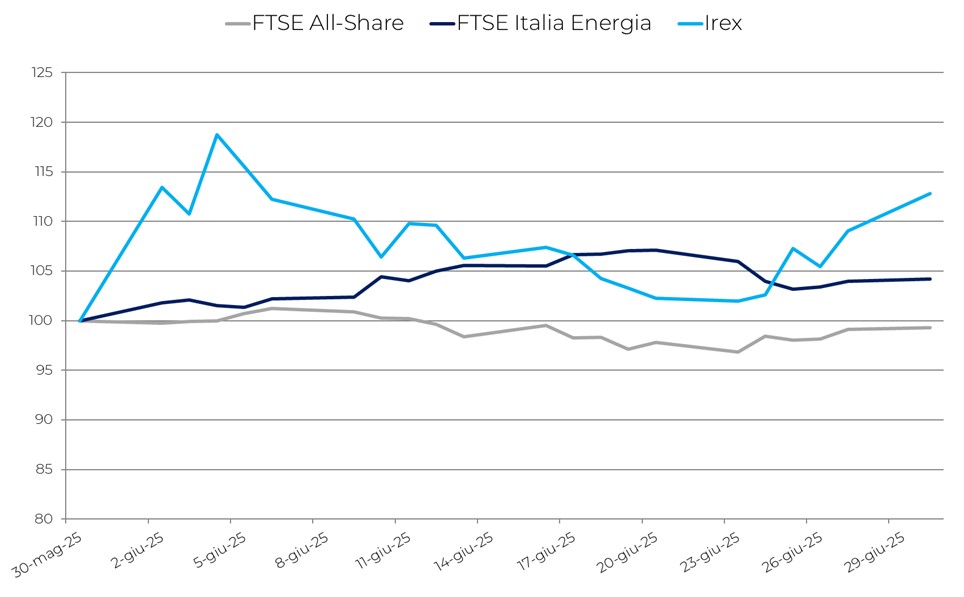

Robust growth for the IREX Index in June, which rose by +12.8%, recovering the steady decline recorded since the start of the year and returning to mid-December 2024 levels (20,250).

During the month, the main European stock indices showed a contraction: the DAX fell by 0.4%, while the IBEX and CAC were down by 1.1%. Oil prices increased sharply—Brent by +5.8% and WTI by +7.1%—as did the PUN (+19.4%), while TTF gas dropped by 5.8%.

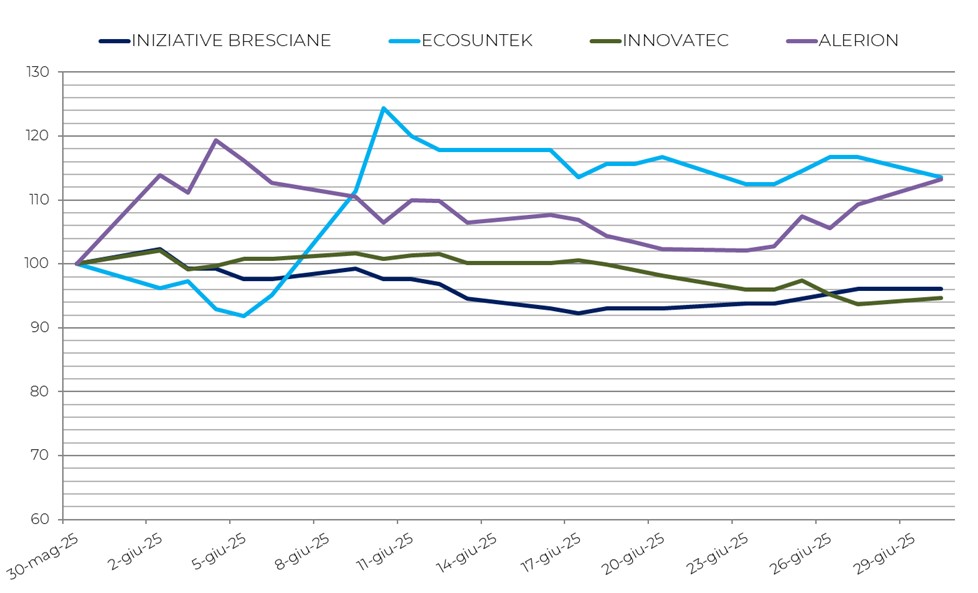

Italian small and mid-caps active in the renewable-energy sector showed positive trends. Ecosuntek was the best performer (+13.5%), supported by a favorable market response to the stock split and improved ratings. Alerion ranked second (+13.2%) after presenting its 2025-2028 business plan and closing several operations. Iniziative Bresciane (-3.9%) and Innovatec (-5.4%) continued to decline: the former was penalized by uncertainty following the resignation of its CEO and the distribution of a script dividend, while the latter continued to suffer from weak financial results and negative analyst sentiment.

Meanwhile, the global economy is slowing at a pace not seen since 2008, outside of formal recessions. Over the past two years, global trade has grown by only 2.8% (World Bank), marking an unusually weak performance by pre-crisis standards. The return of tariff barriers has increased trade costs and fueled inflationary expectations among consumers.

International financial conditions have tightened compared to the end of 2024: equity markets remain volatile, while long-term government bond yields have risen in advanced economies. In emerging markets, sovereign spreads have widened, with only partial subsequent corrections. Central banks continue their monetary tightening, further widening the gap between borrowing costs and savings yields.

Many public accounts remain in deficit, burdened by past stimulus measures and persistently weak growth. Market confidence has yet to return sustainably, weighed down by ongoing uncertainty over tariffs, geopolitics, and extreme climate events.

The European Union is particularly affected by global trade turbulence, given its high degree of openness and integration into global value chains. New barriers are further undermining exports, exacerbating the competitiveness decline already observed in recent years due to higher energy costs.

In this context, the Italian economy is expected to grow modestly: +0.6% in 2025, +0.8% in 2026, and +0.7% in 2027 (Bank of Italy), driven mainly by domestic consumption. Rising tariffs and fragile international trade relations will weigh on investment and exports, cutting overall growth by about half a percentage point over the three-year period. Inflation will remain contained (1.5% in 2025–26), with a slight uptick to 2.0% in 2027 following the extension of the ETS2 system to fuels.

Interest rates will gradually decline, supporting a mild recovery in investment, though the end of building-related tax incentives will limit its impact. Exports will fall in 2025 but are expected to grow again over the following two years, albeit lagging behind external demand. Imports, meanwhile, will continue to rise, supported by domestic demand.

Employment is expected to grow moderately, accompanied by a slight recovery in productivity and a decline in the unemployment rate to around 6% by 2027.

The June rally of the IREX Index could mark the start of renewed momentum for the Italian renewable-energy sector, though uncertainties remain. The window has been set for bids in the first transitional FER X auctions (July–September), with up to 8 GW of photovoltaic and 2.5 GW of wind capacity to be allocated. A second auction is also planned for 1.6 GW of photovoltaic capacity, subject to Net Zero Industry Act resilience criteria—i.e., projects using non-Chinese components.

Under FER 2, the second round of competitive procedures for biomass, biogas, and floating PV will begin in July, while offshore wind remains absent, despite its potentially much greater investment value.

At the end of June, the European Commission issued a comfort letter approving the support scheme for large electricity consumers to develop renewable capacity (“Energy Release”), deeming it compatible with State-aid rules.

In conclusion, despite these signals, support for the sector still lacks the continuity needed to provide a decisive boost toward achieving the 2030 decarbonization targets and restoring investor and market confidence.

The performance of the four best- and worst-performing stocks