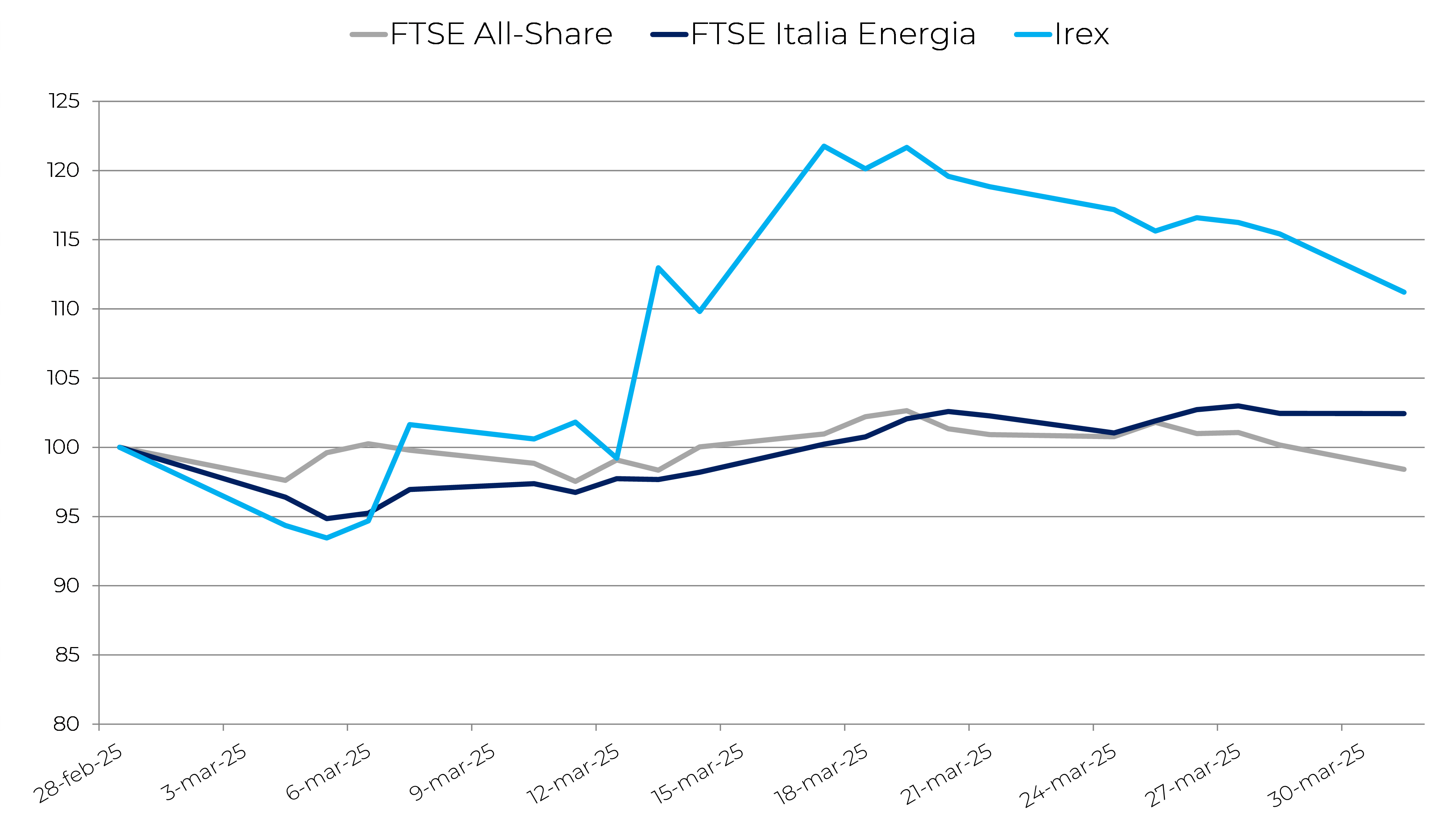

After the 18.3% plunge recorded in February, the IREX Index rebounded by 11.2% in March, closing at 16,171 points. However, this recovery was not sufficient to bring the index back to January levels, remaining 9% lower.

The index of pure renewable small and mid-caps listed on Borsa Italiana diverged from the negative performance of the FTSE All-Share (-1.6%), instead aligning with other European markets (DAX -1.7%, CAC +4.0%, IBEX -1.6%). The IREX Index also outperformed the FTSE Italia Energia, which still showed a positive result (+2.4%).

Energy prices displayed a mixed trend. Brent and WTI crude both recovered (+2.2% and +2.1%, respectively) after the significant declines of the previous month (-4.7% and -5.2%). Conversely, TTF gas recorded a further sharp drop (-11.7%), while the PUN (Italian wholesale electricity price) collapsed by 19.8%.

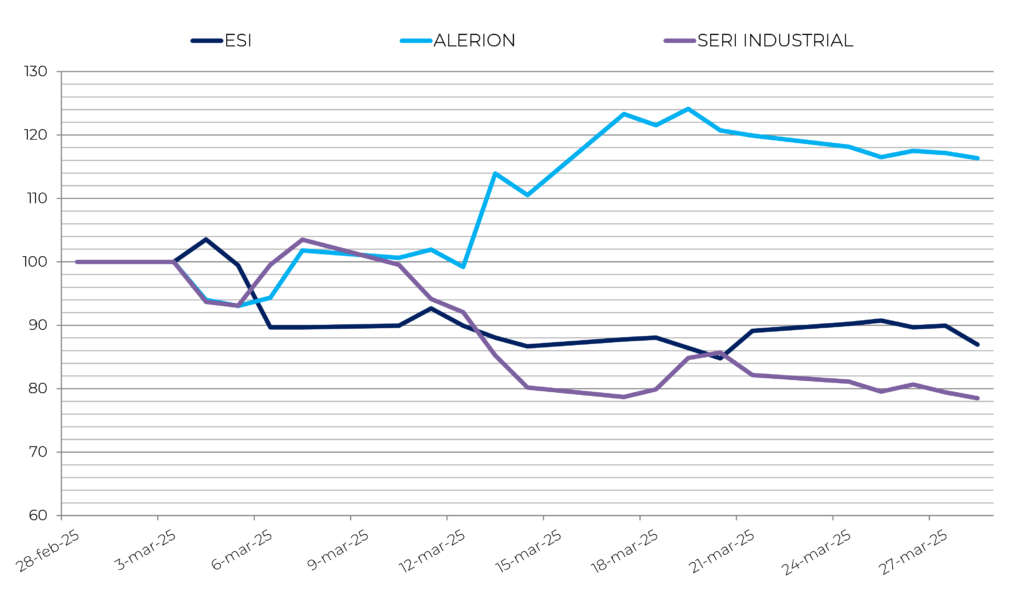

Most renewable-energy companies continued to post negative performances. The only notable exception was Alerion, which rebounded by +12.0% after a -19.2% fall in February. The previous decline had been caused by downward revisions to sales and profitability forecasts, as well as weaker revenues and EBITDA over the first nine months of 2024.

The worst performers within the index were ESI (-16.8%) and Seri Industrial (-21.9%). In the case of ESI, the operational improvement seen in the previous month was not enough to offset the negative market sentiment and uncertainty following changes at the top of the board. Positive financial results and development activity were insufficient to reassure investors.

Seri Industrial was also affected by the prevailing uncertainty. Despite the authorization to repurchase its own shares and the confirmation of independence for a newly appointed director, market reactions remained cautious. These corporate actions were not enough to counteract the broader negative pressures.

The global economy is slowing down, with forecasts for real GDP growth revised to 3.1% in 2025 and 3.0% in 2026 (OECD). The outlook remains uncertain: domestic demand is weak in several countries, inflation is still persistent, and geopolitical tensions add to trade frictions. The risk of global economic fragmentation is tangible, and tighter monetary policies could return to prominence should prices rise above expectations. Conversely, an easing of trade barriers could provide some support to growth.

Forecasts for the United States point to a slowdown to 2.2% in 2025 and 1.6% in 2026. In China, growth is expected to reach 4.8% in 2025 and 4.4% in 2026. The Euro Area remains on a modest path, with projected growth of 1.0% in 2025 and 1.2% in 2026. For Germany, GDP is expected to increase by 0.4% in 2025 and 1.1% in 2026. In France, forecasts point to 0.8% in 2025 and 1.0% in 2026, while Italy is expected to grow by 0.7% in 2025 and 0.9% in 2026 (OECD).

On the trade front, the risk of renewed protectionism remains high. An OECD simulation showed that a 10% increase in bilateral tariffs on all non-energy goods between the U.S. and the rest of the world would reduce global GDP by 0.3% after three years compared to the baseline scenario, while raising global inflation by 0.4 percentage points per year on average. The largest impacts would hit Mexico, followed by Canada and the United States itself. Japan, the Euro Area, and China would also experience negative—though milder—effects.

In the renewable-energy sector, the trade policies of the Trump administration, particularly those targeting China, have jeopardized access to critical minerals essential for clean-energy technologies. In response, Beijing has imposed export controls on rare earths, which are vital for the production of solar modules, wind turbines, and batteries.

Moreover, uncertainty surrounding trade conflicts and energy policies has pushed investors to seek opportunities outside the United States. Several developing economies, particularly in Latin America and the Mediterranean, have emerged as attractive destinations for solar and wind investments, thanks to favorable natural resources and supportive local policies.

In this context, the recent rebound of the IREX Index may signal renewed investor interest in the sector but should not be interpreted as proof that its structural challenges have been overcome. Rather, it reflects temporary momentum driven by specific regulatory and market developments.

Among these, the results of the sixteenth and final GSE auction under the FER 1 scheme played a significant role, with the entire available capacity—nearly 460 MW—allocated. However, the regulatory framework remains transitional, with attention now shifting to the FER X scheme in its interim version. Ahead of the next auction, expected in the first half of 2025, intense competition is anticipated given the large volume of authorized and pending projects compared to the available capacity.

A further key development came with ARERA’s Resolution 128/2025, which extended compensation for curtailments—previously granted only to wind operators—to the solar sector as well. The decision followed Terna’s warning of an increased need to curtail non-programmable renewable generation from spring 2025 onward to maintain grid security.

In conclusion, the renewable-energy sector remains one of the most dynamic and promising segments of the economy but also one of the most exposed to the side effects of trade wars, regulatory uncertainty, and infrastructure delays. A stable, competitive environment with effective governance remains a fundamental prerequisite for its continued growth.