The IREX Index continued the negative trend that began in May 2024, falling by 8.3% in January 2025 and closing at 17,797 points (-39.6% year-on-year).

After a -7.5% decline in December, the index of pure renewable small and mid-caps listed on Borsa Italiana once again diverged from the broader market’s positive performance: the FTSE All-Share rose +6.5%, the FTSE Italia Energia +3.4%, and the main European indices also advanced (DAX +9.2%, CAC +7.7%, IBEX +6.7%). Energy prices also increased: Brent and WTI both rose by +2.6%, TTF gas jumped +9.4%, and the PUN increased by +5.9%.

However, renewables did not benefit from this trend—despite the greater theoretical appeal of green investments—remaining penalized by slower policy support and institutional uncertainty.

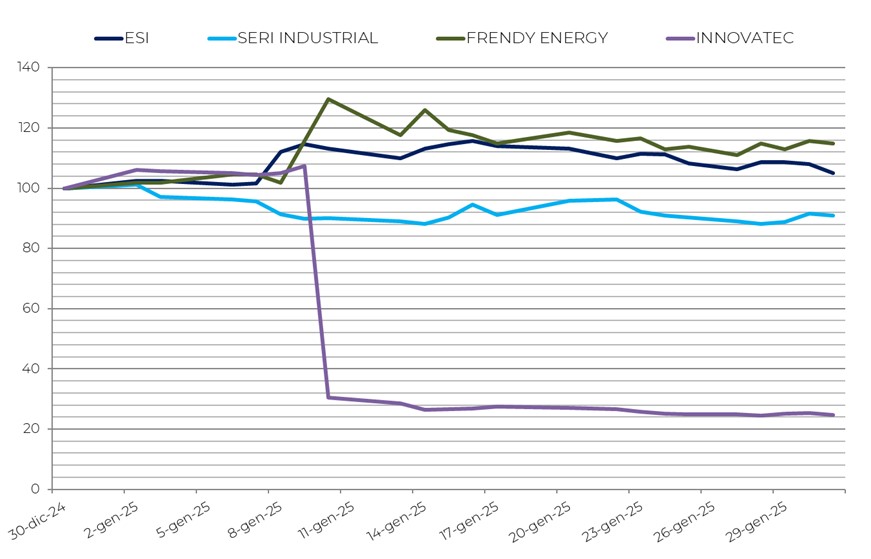

Some companies in the sector posted positive performances, while others suffered heavy losses. Frendy Energy (+14.8%) recorded sustained growth thanks to strong financial results and encouraging development prospects following the acquisition of new plants. ESI (+5.1%) also rose modestly after announcing several small contracts, while Iniziative Bresciane (+3.4%) closed the month positively, supported by an operational efficiency program aimed at optimizing cost management.

On the negative side, two companies stood out. Innovatec plunged -75.2% following the demerger in favor of Haiki+, which will hold the environment and circular-economy business unit, and after a downward revision of revenue forecasts due to delays in obtaining permits. Seri Industrial also fell sharply (-9.1%), likely due to early leaks about 2024 results and 2025 guidance.

Global GDP growth is projected at 3.3% in 2025 and 2026, below the historical average of 3.7% (2000–2019) (IMF). The 2025 forecast remains broadly unchanged from October 2024, thanks to an upward revision for the United States (2.7%), offsetting weaker performances in other major economies. However, the Euro Area remains fragile, with growth expected at 1.0%, and Italy at +0.7%, unchanged from the previous year. Germany, revised down sharply (from -0.2% in 2024 to +0.3% in 2025), may further weigh on European economic confidence.

Globally, inflation is expected to decline to 4.2% in 2025 and 3.5% in 2026, with advanced economies reaching price-stability targets earlier than emerging ones. Nevertheless, the overall picture remains uncertain: monetary and fiscal policies, geopolitical risks, and financial stability will play crucial roles in shaping growth over the next few years.

This macroeconomic backdrop is having a clear impact on the renewable-energy sector and the IREX Index, which continues to feel the effects of Europe’s sluggish growth and domestic regulatory uncertainty. In Italy, the sector awaits the implementation of new policy measures. The latest initiative—the transitional FER X scheme for 2025, supporting mature renewables—has been signed by the MASE, but timelines for competitive procedures remain undefined. The same uncertainty applies to the MACSE mechanism for storage investments.

Meanwhile, Donald Trump’s return to the White House and the U.S. withdrawal from the Paris Agreement have raised concerns over a renewed shift toward fossil fuels. The full impact of this decision on the global energy market remains to be seen.

The trade war and tariffs imposed by the United States could have contrasting effects—penalizing European industrial exports, but potentially lowering Chinese technology prices, as Chinese manufacturers seek new markets in Europe. In this regard, the EU’s new industrial policy, promised within the first 100 days of the von der Leyen II Commission, is awaited as a potential turning point to strengthen Europe’s competitiveness in green-technology manufacturing.

At the same time, Italy continues its energy policy shift toward nuclear power. The MASE has submitted to Palazzo Chigi a draft enabling law to regulate nuclear energy production, including fusion and hydrogen from nuclear sources. The government will have 24 months to adopt the implementing decrees.

Overall, 2025 appears to be following in the footsteps of 2024 for the Italian renewable-energy sector. Whether a true turning point will occur depends not only on how quickly policy action addresses the current industrial crisis, but also on how the energy sector responds to the re-emerging gas emergency—a challenge that, hopefully, the Russia–Ukraine peace process could help mitigate.