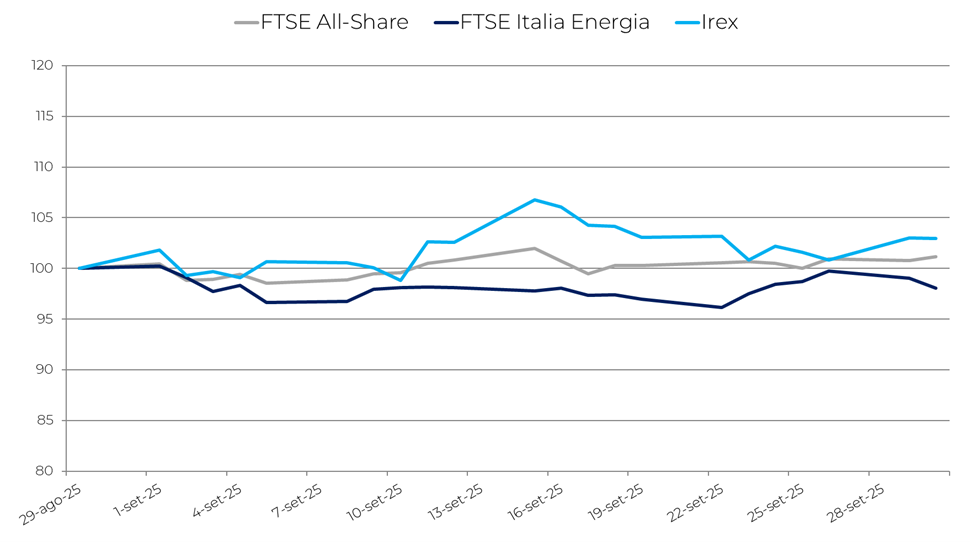

After the sharp rally recorded during the summer months, the IREX Index entered a phase of stabilization, closing the month up by +3% compared to the previous one.

The performance of the index—which tracks Italian small and mid-cap companies operating purely in renewable energy and smart energy—was stronger than that of the FTSE All-Share (+1.2%) and the FTSE Italia Energia (-1.9%), the latter affected by energy commodity trends and weaker-than-expected demand.

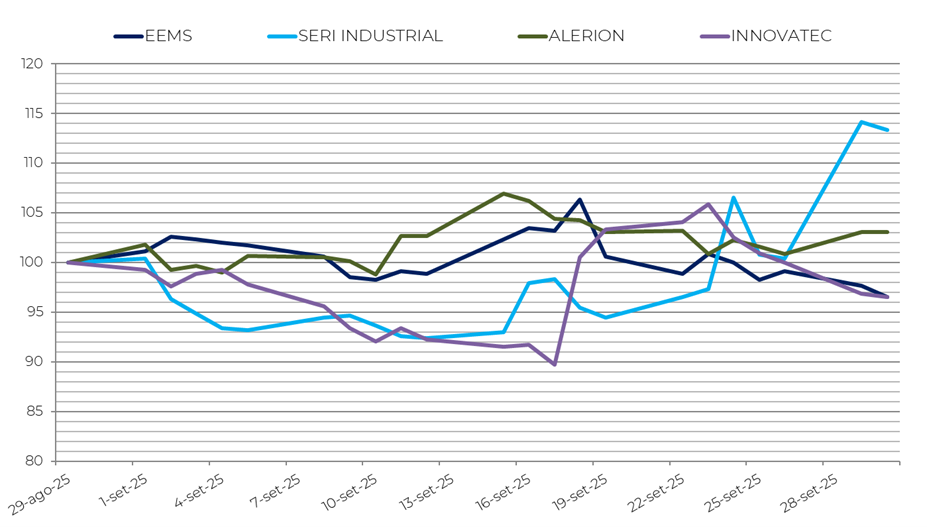

The companies within the index showed mixed results during the month. Seri Industrial was the top performer (+13.3%), driven by the start of operations of its joint venture with Eni, Eni Storage Systems, focused on developing a lithium-battery production project in Brindisi. Alerion also closed the month higher (+3.1%), after peaking mid-month before stabilizing, supported by the acquisition of an onshore wind farm in Ireland. Among the declining stocks were Innovatec (-3.5%) and EEMS (-3.5%). The former continued the negative trend of previous months, worsened by revisions to its 2025 business plan that postponed financial targets to later years. The latter was affected by the withdrawal of approval for its 2024 accounts and governance changes. Overall, the sector showed a balance between gains and losses, with a slight prevalence of positive performances.

Across Europe, major stock indices posted mixed results: the DAX closed slightly lower (-0.1%), while the CAC and IBEX rose by +2.5% and +3.6%, respectively.

On the commodities front, Brent crude fell by 1.6% and WTI by 2.5%, while TTF gas recorded a modest increase (+1.3%), as did the PUN (+0.3%).

The international context remains marked by moderate growth and persistent uncertainty. After a stronger-than-expected first half of the year, global growth is projected at 3.2% in 2025, compared with 3.3% in 2024 (OECD). Inflation in G20 countries is expected to decline, although significant risks remain from rising tariffs and market volatility.

In this environment, Italy’s economy is expected to see limited growth of around 0.5% in 2025 (ISTAT), mainly supported by gross fixed capital formation (+1.6%) and stable household consumption. Inflation remains contained, though with heterogeneous trends. Confidence indicators show signs of improvement, especially among consumers, whose expectations for the general economic situation and the future are more optimistic.

The IREX Index has thus continued the consolidation phase that began in the summer, supported by investor interest in stocks linked to renewable energy and the energy transition. This trend reflects the relative stability of the national energy framework and positive market expectations, albeit in a cautious context. The sector also benefited from several developments: amendments to the Testo Unico simplifying the repowering of existing plants; the launch of the FER X Decree, with expressions of interest open from 16 to 26 September 2025; the extension until 10 November for SMEs applying for self-production incentives for clean energy; and the publication of Conto Termico 3.0 in the Official Gazette.

In the coming months, the implementation of transition-support policies, the trajectory of interest rates, and energy-price dynamics will remain the key factors to watch.

The performance of the four best- and worst-performing stocks