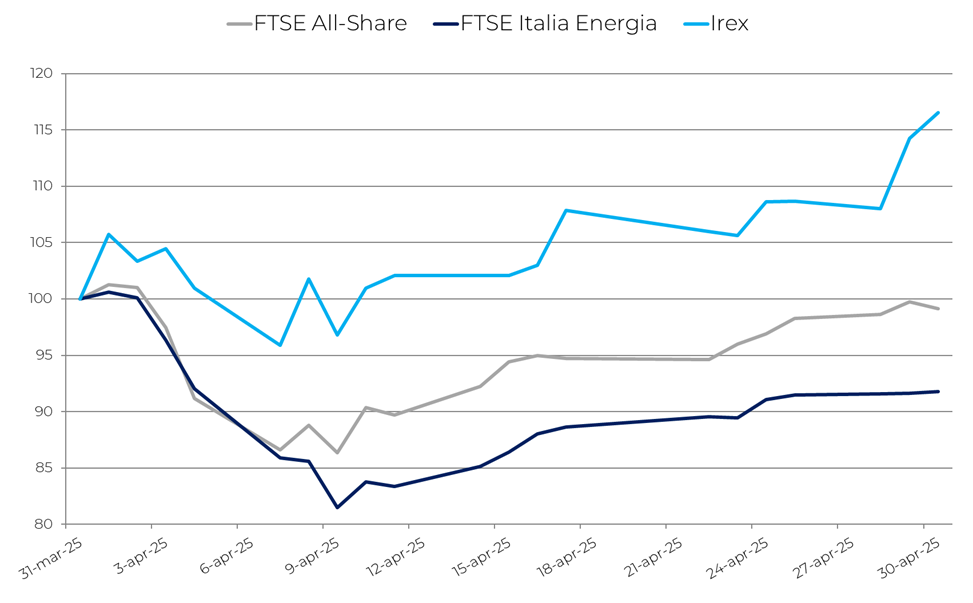

The performance of the main Borsa Italiana indices and the IREX Index

The IREX Index continued its upward trajectory: after the sharp fall of -18.3% in February and the rebound of +11.2% in March, it posted a +16.5% increase in April, closing at 18,841 points. However, this recovery is still insufficient to return to January levels, remaining 3% below that threshold.

In April 2025, the main European stock indices showed moderate stability: the DAX rose by 1.5%, the IBEX by 1.2%, while the CAC slipped slightly by 0.3%. In contrast, energy commodities recorded significant declines: Brent crude fell by 15.5%, TTF gas by 21.1%, and the PUN by 17.2%.

Italian small and mid-cap renewables displayed mixed performances, influenced by specific corporate events. Seri Industrial recorded the sharpest increase (+26.2%) following the announcement of a €150 million financing package for the expansion of the Teverola 2 gigafactory. Alerion also performed well (+17.2%), supported by the confirmation of its 2025 guidance and the approval of a €0.61 per-share dividend. Conversely, Iniziative Bresciane fell by 6.1%, despite issuing a €5 million minibond and distributing a scrip dividend, likely penalized by profit-taking or investor caution. The weakest result came from EEMS (-11.6%), which postponed approval of its 2024 financial statements, increasing uncertainty among investors. Overall, the market rewarded companies with clear industrial strategies and active development plans, while penalizing those with limited visibility or signs of instability.

In 2025, the global economy has slowed due to escalating trade tensions, triggered by generalized U.S. tariffs and retaliatory measures. Growth forecasts have been revised downward, with strong uncertainty weighing on investment and international trade, while global inflation remains elevated.

Advanced economies are among the hardest hit: growth is expected at 1.4% in 2025 and 1.5% in 2026 (IMF). The United States, at the center of the tariff conflict, is forecast to halve its growth compared to 2024, reaching +1.8% in 2025 and +1.7% in 2026, due to political uncertainty, weaker domestic demand, and trade disruption. In China, growth is expected to remain at 4.0% in both 2025 and 2026, well below pre-pandemic levels, constrained by U.S. trade barriers and global uncertainty.

In the Eurozone, growth remains weak, with +0.8% in 2025 and a slight improvement to +1.2% in 2026. Germany, highly dependent on exports, shows zero growth in 2025 and a modest +0.9% in 2026. France maintains a slightly better pace (+1.0% in both years), while Spain stands out with stronger dynamics (+2.5% in 2025 and +1.8% in 2026), supported by lower exposure to tariff tensions.

In Italy, GDP grew by 0.3% quarter-on-quarter and 0.6% year-on-year in the first quarter of 2025, driven particularly by the agriculture and industrial sectors. For the full year, the IMF expects growth of 0.4%, set to double in 2026. Employment rose by 0.9%, with improvements across age groups and contract types. Harmonized inflation stood at 2.1%, stable compared to the previous month, while business and consumer confidence remained weak.

The Italian renewable-energy sector continues to represent one of the most dynamic components of the economy, though it still operates within a framework marked by regulatory and financial uncertainty. The most significant event of the month was ARERA’s publication of the consultation document (DCO) on the maximum premium for MACSE, the capacity support mechanism for energy-storage systems.

On the incentives front, however, no substantial progress was made regarding the FER X Decree. The transitional version foresees only one auction during 2025, raising concerns among operators due to strike prices deemed too low, which could discourage full participation despite the high number of projects already authorized or nearing authorization. Despite these issues, structural data confirm a strong momentum in the sector. According to the IREX Annual Report 2025, the past year saw an acceleration in M&A activity in Italy, with 1,834 transactions (+55% compared to 2023), installed capacity reaching 81.6 GW, and an overall value of €121 billion. Within this context, the recent recovery of the IREX Index signals a cautious return of investor confidence in the renewables market.

The performance of the four worst- and best-performing stocks