After the consolidation phase that characterized the previous months, the Irex Index accelerated in October, posting a particularly positive performance. The index, which includes Italian small and mid-cap companies operating in the renewable energy and smart energy sectors, closed the month at 23,701 points, up 6.3% compared to September. It reached its yearly highs with a spike at the end of the month (October 29–30) before stabilizing at still elevated levels.

The Irex performance is in line with the main Italian stock indices. The FTSE Italia All-Share recorded an increase of 1.1%, while the FTSE Italia Energia rose by 6.4%. This trend was supported by a positive investor sentiment, particularly toward companies focused on renewable energy generation and storage systems, in a context of stable electricity prices and encouraging investment prospects.

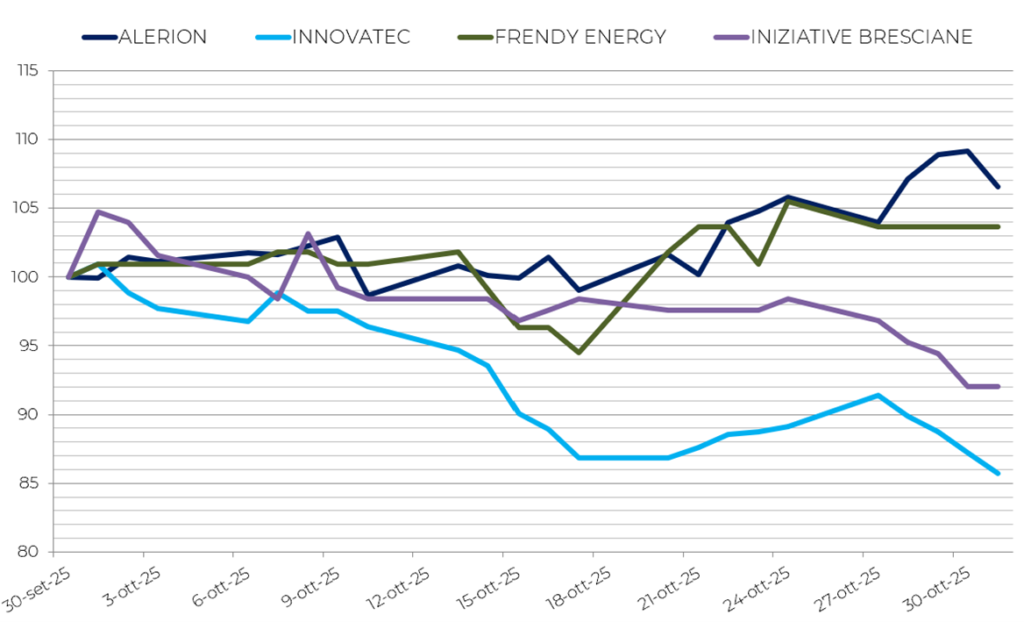

Companies in the basket showed mixed but overall positive results. Alerion confirmed itself among the two best-performing stocks of the month (+6.6%), thanks to the strengthening of its wind pipeline and the acquisition of a wind farm in Ireland. Frendy Energy also performed well (+3.7%), benefiting from improved margins in mini-hydroelectric. On the downside, Ecosuntek (-1.8%), Esi (-2.6%), Eems (-3.9%), Seri Industrial (-4.3%), Iniziative Bresciane (-7.9%), and Innovatec (-14.3%). The latter continues its negative phase linked to the revision of its industrial plan and declining operating margins, in a less favorable environmental services market. Overall, the sector closed the month with a positive balance, driven by stocks related to wind power production and storage technologies.

Major European indices also showed mixed trends during the month. The DAX closed slightly higher (+0.3%), the CAC 40 rose by +2.9%, and the IBEX 35 by +3.6%, confirming the positive trend of continental markets. The Italian stock market moved in line with the European trend, but the Irex performance stood out for its stronger growth compared to the general market and traditional energy stocks. On the energy commodities front, Brent settled at $65.05/bbl, down 2% on a monthly basis, while WTI closed at $60.90/bbl (-2.4%). Gas also fell, with the TTF spot price down -4.6%, while the PUN rose by 1.8%.

The international macroeconomic context remains oriented toward moderate growth. Global growth is forecast at 3.2% in 2025 and 2.9% in 2026 (Source: OECD), with declining inflation. Recent analyses broadly confirm the resilience of the global economy, albeit with risks linked to the tightening of U.S. tariffs and the weakness of international trade. In Europe, growth remains weak, while in Italy, in the second quarter of 2025, GDP decreased by 0.1% compared to the previous quarter but increased by 0.4% compared to the same period in 2024. Final national consumption remained stable, while gross fixed investments increased by 1.6% on a quarterly basis. Imports grew by 0.4%, and exports fell by 1.9%. Latest estimates show Italian GDP growing by 0.6% in 2025 and 0.8% in 2026, after increasing by 0.7% in the previous two years.

The Irex Index is benefiting from a regulatory framework that is stabilizing, albeit still incomplete, and from growing investor interest. During the month, there were no significant developments, but the market is awaiting upcoming measures that could further boost the sector.

The positive close in October demonstrates the resilience of Italian renewable energy companies. In the coming months, attention will focus on the evolution of auctions, energy prices, and support policies, which will continue to influence valuations and investments in the field.

The performance of the four worst and best-performing stocks