After the decline recorded in December, the IREX index begins 2026 by continuing its downward trend and closes January with a further decrease. The basket of Italian small–mid caps active in renewables and smart energy stands at 20,851 points, marking a 2.2% drop compared to the end of December. The monthly trend shows high volatility in the first part of the month, a sharp fall in the central phase, and a partial recovery in the final sessions, which is nevertheless insufficient to bring the index back to early-period levels.

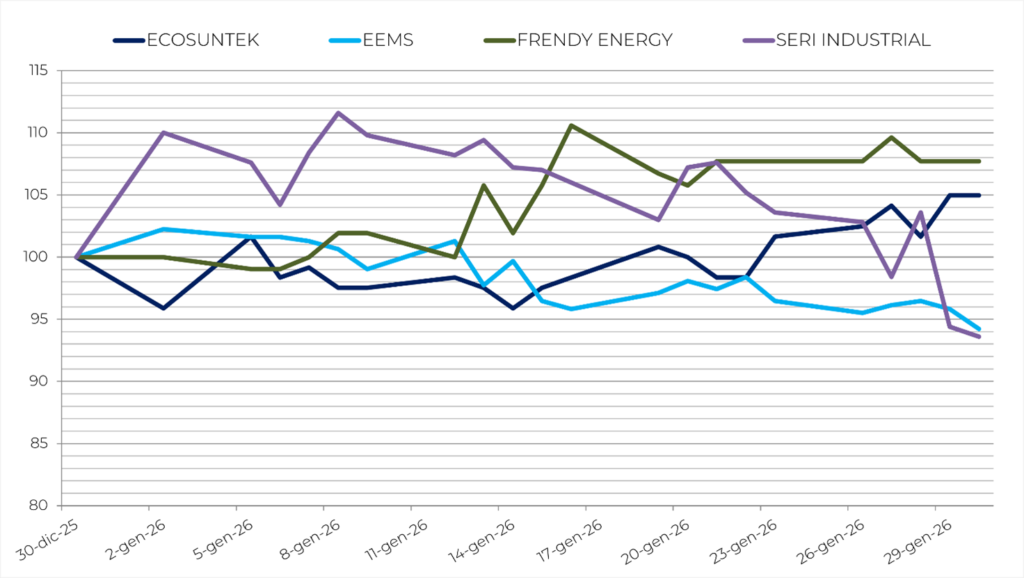

The performance of individual stocks shows a mixed picture, with some positive results in an overall weak context. Among the best performers are Frendy Energy (+7.7%), supported by improved sentiment in the small-scale hydroelectric segment; Ecosuntek (+5.0%), benefiting from selective buying and renewed interest in the stock; and ESI (+2.4%), favored by more stable operational expectations. On the opposite side, Innovatec (–0.6%) shows substantial stability after previous months’ rebounds, while Alerion (–2.3%) continues to be affected by cooling sentiment in the European wind sector. More pronounced declines are seen for EEMS (–5.8%) and Seri Industrial (–6.4%), penalized by profit-taking and lower risk appetite toward industrial small caps in the sector.

The Irex’s performance is weaker than that of the main Italian indices. In January, the FTSE Italia All-Share posts a slight increase of 0.58%, reflecting relative stability in equity market returns, while the FTSE Italia Energia registers +6.78%, showing stronger performance than the Irex and benefiting from oil & gas stocks in a context supported by rising major energy commodities.

Major European indices also display mixed trends in January. The German DAX closes slightly higher (+0.20%), while the French CAC 40 records a moderate decline (–0.36%). Spain shows stronger performance, with the IBEX 35 up 3.24%, supported especially by the banking sector and large-cap stocks. Overall, European markets show a cautiously optimistic start to the year, despite a macroeconomic context still marked by uncertainties.

On the energy commodities front, January sees a sharp rise in oil prices. Brent climbs to $70.70/bbl, up +16.21%, while WTI reaches $65.83/bbl, an increase of +14.49%. The uptrend reflects expectations of stronger demand, persistent geopolitical tensions, and a rebalancing of inventories.

In the electricity market, the Italian PUN rises to €132.66/MWh, up 14.87% compared to December, signaling increased demand-side pressure and less relaxed supply conditions in the peak of the winter season.

The international macroeconomic environment remains characterized by moderate growth despite geopolitical uncertainty. Global growth is expected to reach 3.2% in 2025 and 2.9% in 2026 (OECD data), but remains uneven across major economies. However, uncertainties persist due to slowing global trade, geopolitical tensions, and restrictive trade policies in key regions.

In Italy, the latest available ISTAT data outline a picture of modest growth, with moderate domestic demand. On the price front, in January 2026 inflation (NIC, excluding tobacco) records +0.4% month-on-month and +1.0% year-on-year (down from +1.2% in December), while core inflation remains higher (+1.8%, excluding energy and fresh food). Consumer confidence shows a slight improvement, with the index rising to 96.8 from 96.6 in the previous month.

The IREX index is therefore affected by the persistence of a cautious market environment, energy price volatility, and lower risk appetite toward renewable small–mid caps. While awaiting upcoming regulatory developments and the evolution of the macroeconomic and energy context in the coming months, investor attention remains focused on the financial strength of the companies in the basket and their ability to position themselves profitably along the main paths of the energy transition.

Worst and best performers e best performers