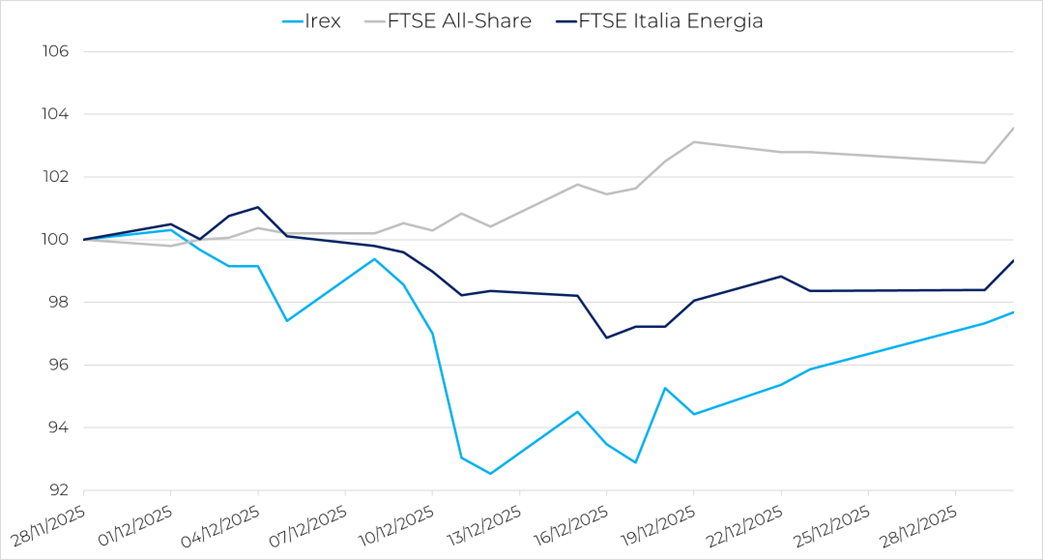

After the sharp decline recorded in November, the Irex index continues its phase of weakness and ends December with a further downturn. The basket of Italian small–mid caps active in renewables and smart energy falls to 21,319 points, marking a –2.3% decrease compared to the end of November. The monthly trend shows an initially uncertain phase, followed by a gradual recovery in the final sessions, which was nevertheless insufficient to bring the index back to previous levels.

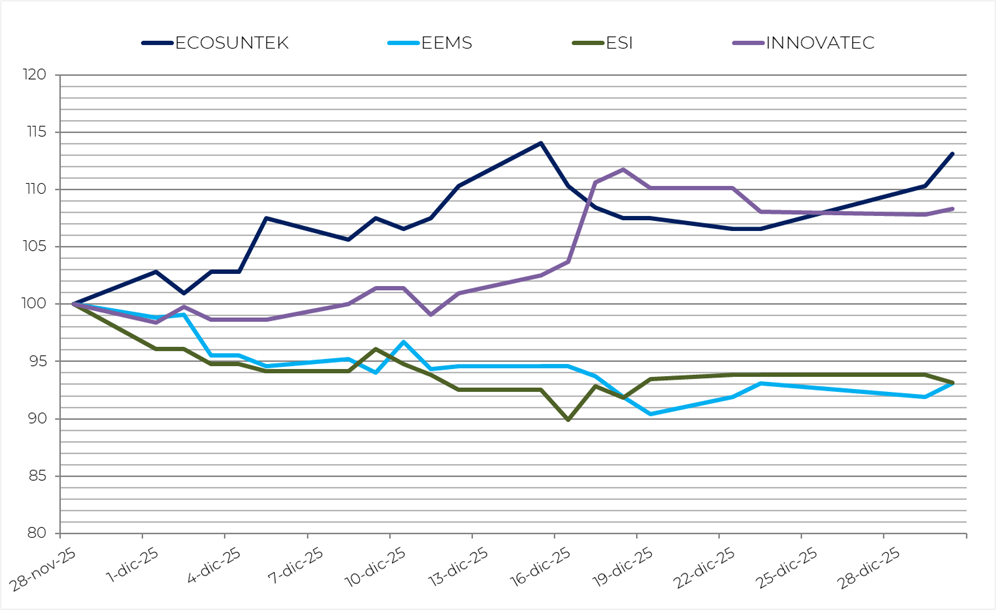

The performance of individual stocks shows a mixed picture, with only a few positive exceptions in an overall weak environment. Among the best performers are Ecosuntek (+13.1%), supported by renewed interest in the stock and selective buying during the month; Innovatec (+8.3%), benefiting from a technical rebound after sharp previous corrections; and Iniziative Bresciane (+3.5%), favored by greater stability in operating expectations. On the negative side are Alerion (–2.4%), penalized by the persistent cooling of sentiment in the European wind sector, and Frendy Energy (–5.5%), affected by less favorable seasonal dynamics in hydroelectric production. Seri Industrial (–6.7%), Esi (–6.8%), and Eems (–6.9%) were impacted by profit-taking and a market environment less inclined to risk in small caps within the sector.

The Irex’s performance is weaker than that of the main Italian indices. The FTSE Italia All-Share records a monthly increase of 3.7%, showing greater resilience than the renewables segment, while the FTSE Italia Energia posts –0.67%, supported by the relatively stronger performance of oil & gas stocks in a context of more contained volatility compared to previous months.

Major European markets also show varied dynamics in December. Germany’s DAX closes up 2.78%, benefiting from the recovery of industrial and technology stocks, while France’s CAC 40 posts a more modest gain (+0.38%). Spain performs more strongly, with the IBEX 35 rising 5.79%, driven in particular by the banking sector and large-cap stocks. Overall, European markets reflect a more optimistic year-end sentiment despite a still uncertain macroeconomic environment.

On the energy commodities front, Brent falls to $60.84/bbl (–4.04% m/m), while WTI settles at $57.50/bbl (–3.30% m/m), confirming a weakening phase for oil prices. The movement reflects expectations of more moderate global demand, combined with still-high inventories and an international macroeconomic context marked by greater caution. In the electricity market, the Italian PUN stands at €115.49/MWh, down 1.37% from November, indicating more relaxed supply conditions and less tight demand than expected at the start of the winter season.

The international macroeconomic environment remains characterized by moderate growth. According to the OECD Economic Outlook – December 2025, global growth is expected at 3.2% in 2025 and 2.9% in 2026, with inflation gradually easing but still uneven across major economies. However, uncertainties persist regarding the slowdown in global trade, geopolitical tensions, and restrictive trade policies in key areas.

In Italy, the latest Istat data on quarterly national accounts show that in the third quarter of 2025, GDP grew by 0.1% compared to the previous quarter and by 0.6% year-on-year. The trend is supported by gross fixed investments (+0.6%), while national final consumption remains stable (+0.1%). Exports rise 2.6%, compared to a 1.2% increase in imports, outlining a picture of modest but still positive growth.

The Irex index is therefore affected by the persistence of a cautious market environment, the absence of significant regulatory developments during the month, and an overall uncertain regulatory framework. While awaiting upcoming regulatory decisions and the evolution of energy prices, investor attention remains focused on the financial soundness of the companies in the index and their ability to position themselves profitably along the main drivers of the energy transition.

The performance of the four worst and best