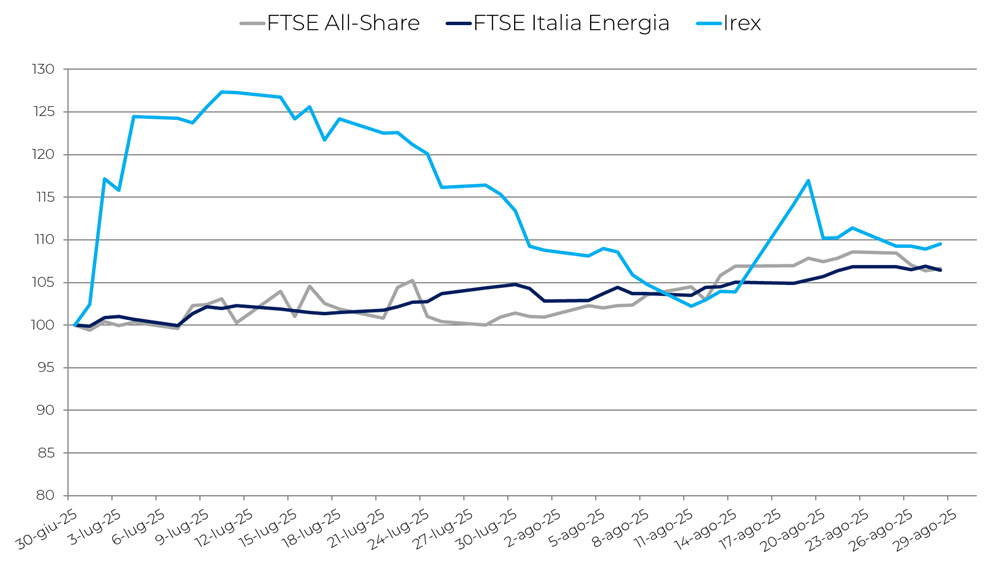

The performance of the main indices of Borsa Italiana and the Irex Index

Listed renewables experienced a positive summer, with the Irex Index posting a 6.9% increase over the July–August period, closing at 21,652 points. This confirms the recovery phase following the strong growth in June (+12.8%), which had brought the Irex back to mid-December 2024 levels after months of decline.

The performance of the index, which tracks Italian pure renewable small-mid caps, slightly outpaced both the FTSE All-Share (+6%) and the FTSE Italia Energy (+6.5%), confirming the strong momentum of the energy sector on the stock market.

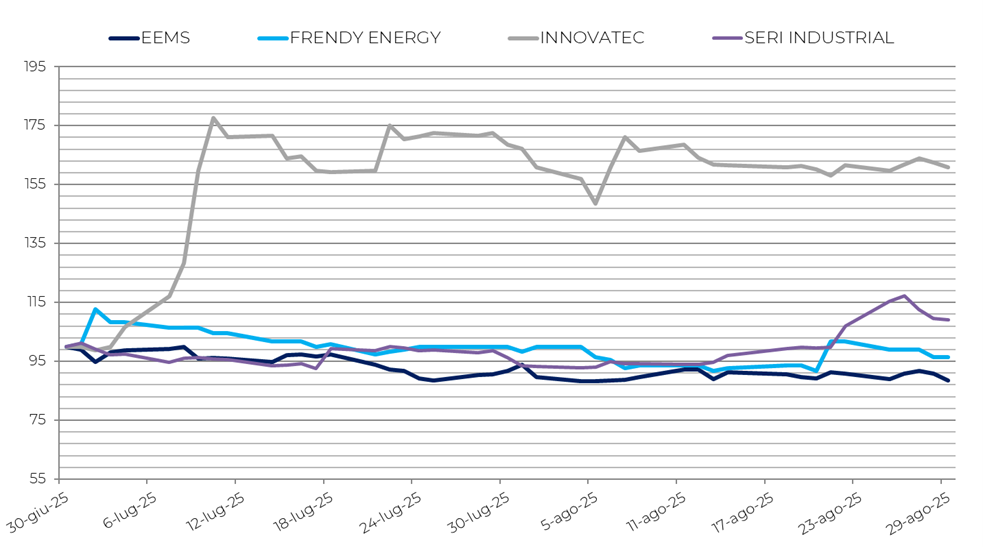

Among individual stocks, Ecosuntek (+13.5%) and Alerion (+13.2%) continued to lead the gains, benefiting respectively from the positive impact of a stock split and a new industrial plan. Meanwhile, Innovatec (-5.4%) and Iniziative Bresciane (-3.9%) extended the downward trend already seen in June. Innovatec appears to have been affected by a “sell the news” dynamic: a record spike triggered by a new EPC agreement was followed by heavy profit-taking, pushing the stock into negative territory. Iniziative Bresciane reported weak half-year results due to a decline in hydroelectric production, prompting analysts to lower their target price.

A comparison with major European indices shows mixed performance: Germany’s DAX (-0.03%) and France’s CAC (+0.5%) remained broadly stable, while Spain’s IBEX rose sharply (+6.75%).

In the energy markets, between June and August, Brent crude rose by 0.8% while WTI fell by 1.8%. Natural gas (TTF) declined more significantly (-3.0%), as did Italy’s PUN electricity price (-2.7%), reversing the sharp increase seen in June (+19.4%).

The international context remains complex. The IMF revised global growth upward to 3% for 2025, though still below pre-pandemic levels. The OECD confirms a gradual recovery driven by emerging economies but highlights risks related to trade tensions and economic fragility in certain regions.

Italy’s economy, after a boost in June, shows signs of weakness: GDP fell by 0.1% quarter-on-quarter in Q2, while industrial production rose in July (+0.4%). Employment saw a modest increase (+13,000 units in July), with the rate climbing to 62.8%. Inflation remained subdued at 1.7% in August (source: Istat). Domestic demand remains fragile, and exports are slowing, particularly to non-EU markets (source: Bank of Italy).

In this scenario, the outlook for Italy’s renewable energy sector remains tied to the implementation of support measures. Following the partial FER 2 auctions and the launch of the transitional FER X scheme, unresolved issues persist regarding the continuity of competitive procedures and the clarity of support mechanisms. Moreover, the results of the first FER X auction fell short of expectations. Bids totaled 11.8 GW compared to the 20.4 GW submitted in the initial phase. While photovoltaic offers exceeded the quota (10.1 GW vs. 8 GW), wind energy bids fell short (1.7 GW vs. 2.5 GW available). The launch of the “Energy Release” scheme for large consumers, approved by the European Commission in late June, marks a step forward but is not yet sufficient to dispel investor uncertainty.

Overall, July and August 2025 confirm the Irex’s recovery following June’s sharp rebound, supported by a less volatile energy environment and some policy measures, though still exposed to macroeconomic and regulatory uncertainties affecting the trajectory of Italy’s renewable energy sector.

The performance of worst and best performing stocks